Author(s): Pueyo, A.

Publication date: September 2018

Publication type: Journal article

Journal: World Development

Abstract:

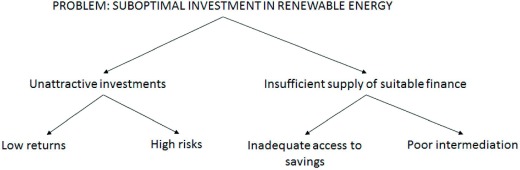

Policymakers in Sub-Saharan Africa face several choices to increase levels of access to electricity under severe budget constraints. First, they need to prioritise technologies that can supply electricity at a low cost. Second, they need to design and implement appropriate policies to attract private investment. On the first choice, renewable energy is becoming increasingly competitive with fossil fuels. Moreover, it contributes to energy security and environmental sustainability, while providing access to new sources of (sustainable) finance. On the second choice, developing countries typically face a multitude of constraints to attract investment to their energy sector. It can be daunting and expensive to address them all at once. This paper presents a new methodology to support policymakers to better target policies for the promotion of commercial-scale renewable energy investment. The methodology, which we call “Green Investment Diagnostics” draws upon the Growth Diagnostics framework, extensively used in the field of Development Economics to identify the binding constraints to economic growth. It is operationalised with a decision tree analysis that builds cumulative evidence to prioritise some constraints over others, through the review of indicators and validation through expert interviews. We apply this approach to Kenya and Ghana, finding that Ghana’s key constraints to investment in renewable energy are an unreliable off-taker, macroeconomic imbalances, regulatory uncertainty, pressures to keep prices low, as well as insufficient and costly domestic finance. Kenya instead offers generous returns to investment in renewables but faces a low demand, a lack of networking infrastructure and problems of governance and social acceptance, exacerbated by uncertain land property rights and rent-seeking.

The article can be accessed here.